| TheCore is our strategic framework. It sets forth the basis from which we operate by defining our vision, mission, critical areas of focus, and values. The framework affirms our corporate values of safety, integrity and trust, respect and inclusion, and accountability. This is the foundation from which our long term strategy is built. For example, employees are an element of our Core and one of our greatest assets. The Core helps us focus on keeping them safe, fostering a healthy and balanced environment, supporting their development through training and mentoring and encouraging engagement. This culture not only benefits each individual employee, it also positions our Company for long-term sustainable success. | |

oPinnacle West increased the dividend for the fourth straight year by 5.0%;

oPinnacle West's share price reached a new all-time high and new 52-week intraday highs on four trading days;

oPinnacle West's earnings of $437 million, or $3.92 per share, represented an increase of 9.5% over 2014 earnings per share;

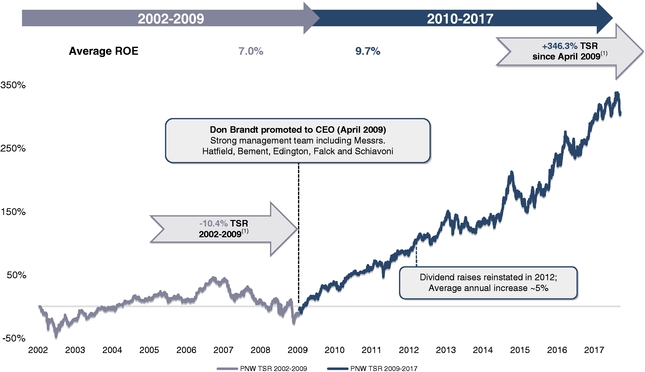

oSince April of 2009, our Company's TSR has outperformed that of the S&P 1500 Electric Utility Index by over 111%. Also during this period, the Company has delivered an annualized TSR of 18.8% and ranked 6th in annualized TSR compared to our Peer Group; and

| | 2016 Proxy Statement | 1 |

2018 Proxy Statement | 1 1

Table of Contents Strategic Priorities TheCore continues to serve as the foundation for all strategic and business initiatives. In turn, our performance metrics reinforce our highest priorities, including operational excellence, financial strength and leveraging economic growth, in a tangible, measurable way, and allow us to monitor and enhance our progress. Building on that foundation, the APS Strategic Business Plan is anchored by four themes that align with industry trends shaping our future and the way we do business: - •

- Consumer Engagement — Deliver value-added programs and services that derive from consumer insights and strengthen our brand for the future

- •

- Flexible Resources — Develop new initiatives and businesses that leverage our core capabilities

- •

- Employees — Adopt sustainable programs to invest in our people today and in the future

- •

- Innovation — Integrate new technologies to enhance performance, reliability and the overall experience of our customers and employees

2017 Highlights and Achievements

|

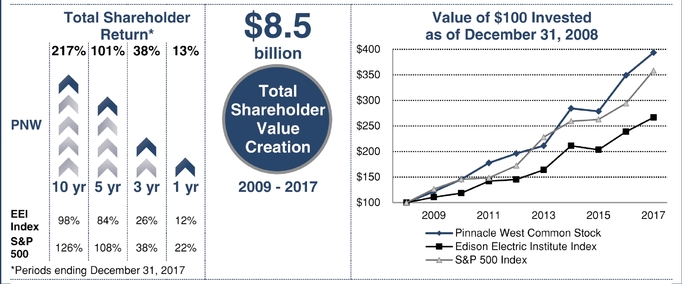

Shareholder Value Our management team has delivered superior performance:

Financial and Operating Highlights | | | | | | ü | | PNWincreased its dividend for the 6th consecutive year, by 6%; | | ü | | Maintainedstrong credit ratings from all three rating agencies; | | ü | | APS spent$363 million with diverse suppliers; | | ü | | APS continued successful operation of the Palo Verde Generating Station, a nuclear energy facility that is the largestclean-air generator in the United States; and | | ü | | Achievedtop quartile distribution reliability metrics for 2017, and had the best summer reliability in 5 years. | | |

2 | 2018 Proxy Statement | 2018 Proxy Statement

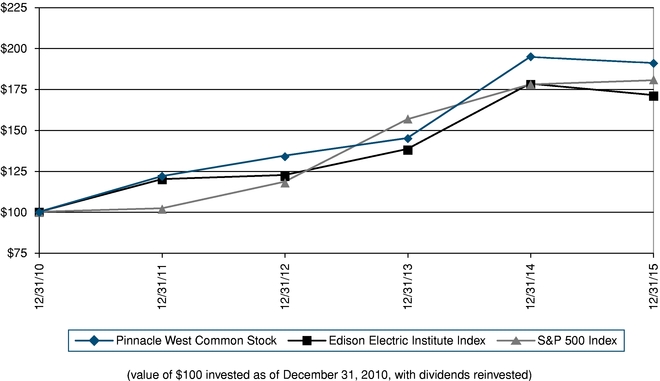

Table of Contents oOur stock continues its competitive performance, as shown by comparing our stock's performance to companies in the Edison Electric Institute Index and in the Standard and Poor's 500 Index:

•Operating Performance:

oArizona Public Service Company ("APS") operates Palo Verde Nuclear Generating Station ("Palo Verde"), the largest nuclear generating station in the United States. In 2015:

•Palo Verde generated more electricity than in any year since it began operating in 1986, 32.5 million megawatt-hours, and it remains the only U.S. generating station to produce more than 30 million megawatt-hours in a year; and

•Palo Verde achieved a capacity factor of 94.3%, and a record capacity factor of 100.2% between June and September;

oAPS crews restored service to more than 50,000 customers after one of the most severe monsoon seasons on record, including the replacement of more than 568 damaged poles;

oOur diverse supplier program continues to be successful, with our 2015 spend exceeding $380 million — the highest total in the program's 23-year history. We were recognized by Edison Electric Institute's Supplier Diversity Executive Council for program innovation and excellence; and

oAPS achieved gas fleet commercial availability of 97.1% during the summer months, exceeding the fleet goal.

| | | | | 2  |2016 Proxy Statementü | | Received theDistributech Renewable Integration Project of the Year award for the Solar Partner Program; | | ü | | Obtained "Leadership" rating from CDP for climate change and water management – one of only two U.S. utilities that earned the highest rating in both categories; | | ü | | Recognized as theCorporate Advocate of the Year by the National Center for American Indian Enterprise Development; and | | ü | | Recognized as aBest Corporation for Veteran's Business Enterprises by the National Veteran-Owned Business Association. | | |

Community Engagement | | | | | | ü | | Contributed more than$9.8 million to our Arizona communities, with more than $1.4 million invested in STEM education; | | ü | | Employees pledged more than$2.4 million through our Company-sponsored charitable giving program, through which the Company provides a 50% match; | | ü | | Built our 35th baseball field in one of our Arizona neighborhoods together with the Arizona Diamondbacks Foundation; and | | ü | | Employees donated nearly110,000 volunteer hours to community organizations. | | |

Sustainability Our commitment to create a sustainable future for our Company and our customers will continue to light our way to success — not just today but for years to come. We continue to make progress on ourfive critical areas of sustainability: | | | | | | | | | Carbon

Management | | • 50% of our diverse energy mix iscarbon-free • Plan toreduce carbon intensity by 23% over the next 15 years • MSCI Environmental Sustainability and GovernanceA rating (as of 10/27/17) | | | | Energy

Innovation | | • More than 1,300 MW of installed solar capacity • Plan to add over500 MW of energy storage in the next 15 years | | | | Safety &

Security | | • 70% reduction in Occupational Safety and Health Administration ("OSHA") recordable injuries over the past 10 years • Remain top decile for safety performance in the U.S. electric utilities industry | | | | Water Resources | | • 14% reduction in groundwater use since 2014 • 20 billion gallons of water recycled each year to cool Palo Verde Generating Station | | | | People | | • Averageemployee tenure of 13 years due to strong talent strategy • More than 20% of our employees areveterans • Palo Verde hosted a nuclearWomen in Leadership forum | | |

To learn more about our sustainability efforts, please see our Corporate Responsibility Report located on our website (www.pinnaclewest.com). 2018 Proxy Statement | ��  3 3

Table of Contents

Our Board remains committed to maintaining strong corporate governance practices. Our practices include: | | | | | | ü | | Adirector retirement policy at age 75; | | ü | | Proxy access rights allowing up to 20 shareholders owning 3% of our outstanding stock for at least 3 years to nominate up to 25% of the Board; | | ü | | Strong ongoing shareholder engagement program that expanded in 2017, including participation of the Lead Director in several shareholder meetings; | | ü | | Independent Lead Director role with clearly defined and robust responsibilities; | | ü | | Ten of our eleven current directors are independent and the members of all of the Board Committees are independent; | | ü | | Annual elections of all directors (see page 5 of this Proxy Statement Summary for a list of the nominees); | | ü | | Robust board and management succession planning; | | ü | | No poison pill plan or similar anti-takeover provision in place; | | ü | | No supermajority provisions in our Articles of Incorporation or Bylaws; | | ü | | Each of our directorsattended at least 90% of the Board meetings and any Board committee meeting on which he or she served; and | | ü | | Our directors and officers are prohibited from pledging or hedging our stock. | | |

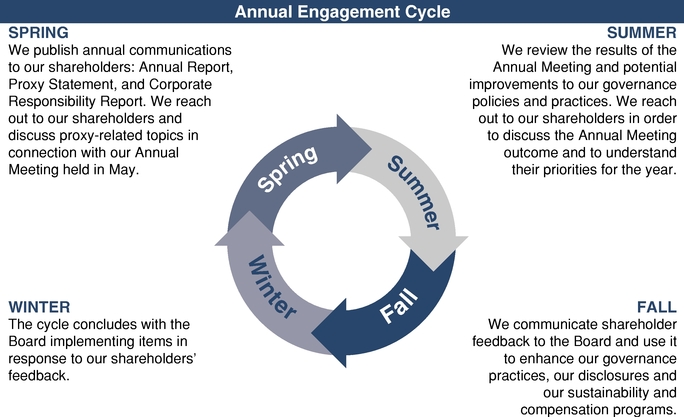

We have an established shareholder engagement program to maintain a dialogue with our shareholders throughout the year, which was further augmented during 2017 in response to what our Board considered a disappointing level of shareholder support for our annual advisory vote on compensation. Each year we strive to respond to shareholder questions in a timely manner, conduct extensive proactive outreach to investors, and evaluate the information we provide to investors in an effort to continuously improve our engagement. In 2017, we contacted the holders of approximately 50% of the shares outstanding and met with the holders of approximately 40% of the shares outstanding. Our Lead Director and member of the Human Resources Committee, Kathryn Munro, participated in a number of the shareholder discussions providing shareholders with direct access to the Board. What our shareholders think is important to us and we want to ensure we have the opportunity to engage directly with our shareholders. We seek to maintain a transparent and productive dialogue with our shareholders by: •üCustomer Value:

oAPS announced plans to join the Energy Imbalance Market administered by the California Independent System Operator;Providing clear and timely information,

oüAPS improved paperless billing adoption,Seeking and now has one of the highest adoption levels at 28% of customers (or 330,000) comparedlistening to the North American average of 21%;

oWe ranked in the top ten nationally among large, investor-owned utilities in the 2015 J.D. Power residential customer satisfaction study;feedback, and

oüAPS was namedBeing responsive.

A detailed discussion of this outreach and the Environmental Protection Agency ENERGY STAR Sustained Excellence partner for the 6th consecutive year basedBoard's response can be found on the effective deliverypages 23-24 and 48-49 of customer energy efficiency programs.this Proxy Statement.

4

•Sustainability: | |

2018 Proxy StatementoWe assessed our sustainability actions to identify our highest priority elements. These elements are: Energy Innovation, Water Resources, Carbon Management, People, and Safety and Security. Examples of 2015 accomplishments in these areas include:

•Energy Innovation: APS launched one of the nation's first utility-owned research and development pilot projects to study the offset of peak energy usage with solar energy production. This project makes solar available to a limited number of APS customers who are not typical customers for rooftop solar or have limited income. The approximate ten megawatt project provides a monthly savings on each participant's electric bill for the use of their rooftop;

•Water Resources: We generated over 37 million megawatt hours of energy using reclaimed water, our highest amount ever;

•Carbon Management: Forty-seven percent of our energy mix was from carbon-free resources;

•People: APS focused on improving the engagement of our employees through over 30 individual business unit and department action plans implemented to enhance employee engagement; and

•Safety and Security: APS had its second lowest number of OSHA recordables and expects to remain within the top decile for electric utilities; additionally, APS continued to implement physical enhancements and cyber security defenses to protect our people and assets.

| | 2016 Proxy Statement | 3 |

Table of Contents | 2015 Highlights: BoardDirector Nominees, Their Skills and GovernanceExperience

|

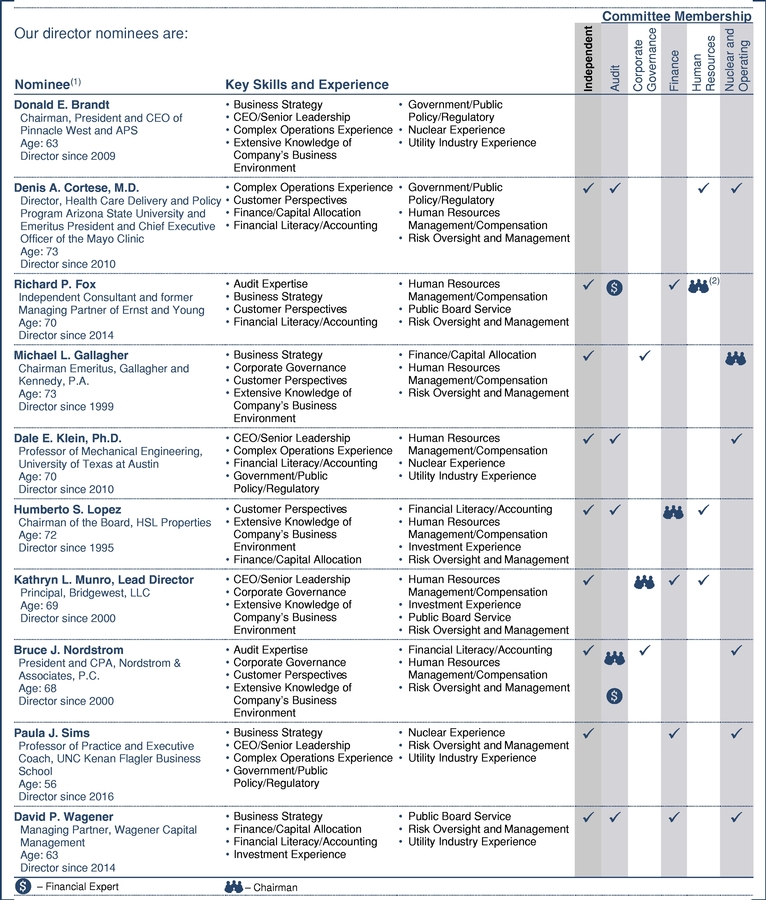

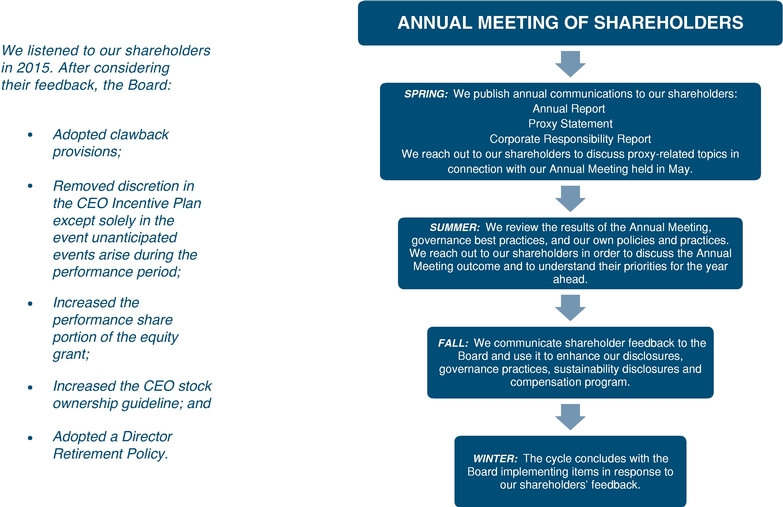

•(1)Governance Changes in 2015:Directors' ages as of February 21, 2018.

o(2)Last year our directors received an average 97% shareholder vote in favorDr. Herberger is currently the Chairman of their electionthe Human Resources Committee and no director received a votewill be retiring effective at the Annual Meeting. Mr. Fox will take over as the Chair of less than 91%;

oWe adopted a Director Retirement Age Policy, see page 19;

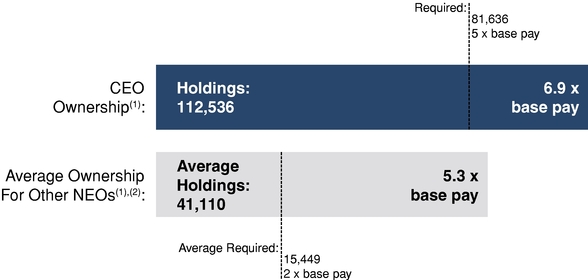

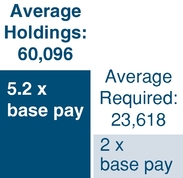

oWe increased the CEO stock ownership requirement to five times base salary; and

oWe enhanced our shareholder engagement process, see page 20.

Human Resources Committee effective at the Annual Meeting.

•Continuing Governance Highlights:

oAnnual election of all directors (see page 7 of this2018 Proxy Statement Summary for a list of the nominees);

|oNine of our ten directors are independent;

oAll members of the committees of our Board are independent;

oOur independent Lead Director has clearly defined and robust responsibilities;

oEach of our directors attended at least 75% of the Board meetings and any Board committee meeting on which he or she served; all of our directors attended the 2015 Annual Meeting of Shareholders;

oWe do not have a poison pill plan;

oOur directors and officers are prohibited from pledging or hedging our stock; and

oWe have director and officer stock ownership guidelines.

| 2015 Highlights: Compensation

|

•Compensation Changes in 2015:

5oStarting with the 2015 Annual CEO Incentive Plan Award (the "CEO Incentive Plan") and continuing with the 2016 Annual CEO Incentive Plan Award, we limit the use of discretion to adjust incentive awards solely to the occurrence of unanticipated events that may arise during the performance period;

oWe changed the allocation of the value of our annual long-term equity awards to 60% performance-based and 40% time-based vesting beginning with the 2016 awards; and

oWe added clawback provisions to our 2016 annual cash incentive plans and performance share equity grant agreements.

4  |2016 Proxy Statement | | |

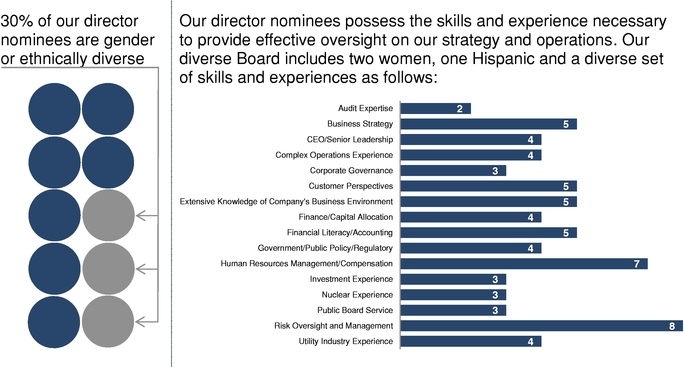

Table of Contents | | | Board Diversity

| | Directors' Key Skills and Experience Matrix

|

|---|

| | | |  |

| | | | Director succession is overseen by the Corporate Governance Committee, which regularly assesses whether the composition of the Board reflects the knowledge, skills, expertise, and diversity appropriate to serve the needs of the Company. Since 2014 three new members have joined the Board. The Board adopted a Director Retirement Policy in 2016, which is described on page 22 of this Proxy Statement, to better facilitate board refreshment and transition. | |

|

Given our need for specialized experience, we also maintain strong management succession planning practices and are focused on developing and retaining talent within our Company. Our Board's focus on attracting, developing and retaining highly skilled and experienced executives is a core consideration in structuring our executive compensation programs. 6 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents •-

Continuing Compensation Highlights:

oWe continued our executiveExecutive Compensation Program Highlights

|

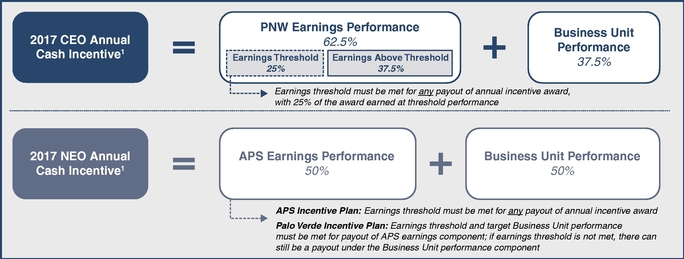

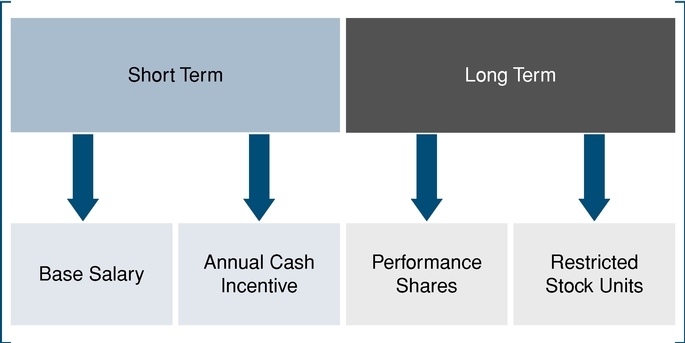

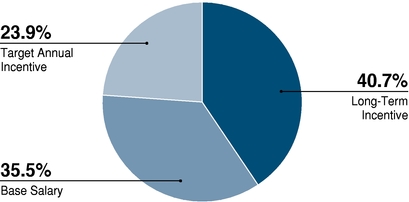

Our compensation program's focus on beingprogram is designed to be transparent with a clear emphasis on rewarding performance by putting pay at risk and retaining key executives. Our executive compensation philosophy incorporatescenters on the following core principles and objectives:

•Alignmentobjectives of maintaining alignment with shareholder interests;interests and retaining key management.Our incentive program structure and metrics are

•Key management retention;designed to drive sustained value creation

•A focus on a few key elements that are simple for shareholders, with incentive compensation tied to the Company's TSR, earnings, and understandable: base salary; annual performance-based cash incentive; three-year performance-based equity grant; a retention-based equity grant that releases over a four-year period; pensionthe achievement of measurable and supplemental pension retirement benefits;sustainable business and limited perquisites;

•A significant portion of our Named Executive Officers' (as definedindividual goals. See the CD&A on page 37 of this Proxy Statement) compensation is at risk and based on performance — our annual cash incentive plans are 100% tied directly to earnings, business unit performance and individual performance, and our performance shares are based on TSR and value-driving business metrics; and

•We use multiple business performance metrics, capped payouts and other features that are designed to reward performance but not encourage unacceptable risk taking.

oPlease see our "Compensation Discussion and Analysis" beginning on page 37 of this Proxy Statement44 for a detailed explanation of our executive compensation program.

| | 2016 Proxy Statement | 5 |

Table of Contents

further details. | Annual Meeting of Shareholders

|

| | | | | | Date: | | May 18, 2016 | Time: | | 10:30 a.m. Mountain Standard Time | Place: | | Heard Museum

2301 North Central Avenue

Phoenix, Arizona 85004 | Record Date: | | March 10, 2016 | Admission to the Meeting: | | An admission card will be required to attend the Annual Meeting. See page 11 of this Proxy Statement under the heading "Attendance at the Annual Meeting" to obtain an admission card. | Delivery of Materials: | | Proxy Statement and form of proxy are first being made available to shareholders on or about March 31, 2016. |

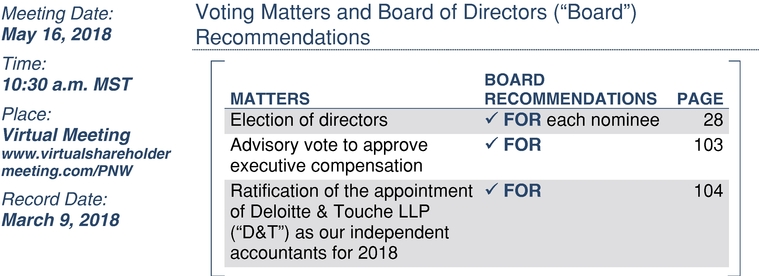

| Voting Matters and Board of Directors ("Board") Recommendations

|

| | | | | | | | | | | | | | | | | MATTERS

| | BOARD

RECOMMENDATIONS

| |

| PAGE |

| |

| |

| |

| |

| |

|

|---|

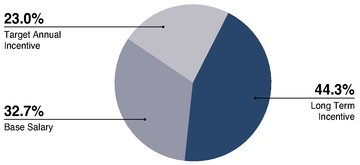

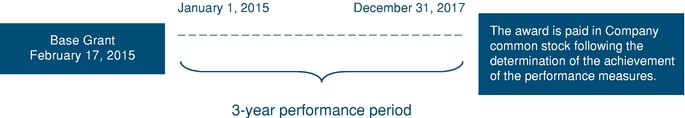

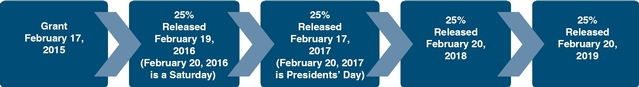

| | | | | | | | | | | | | | | | | | | | Pay Element | | | | Measurement

Period |

| | | Performance Link | | | | | | | | | | | | | | | | | | | | | | | Base Salary | | | | Cash | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Annual | | | | Cash | | | | 1 year | | | | Earnings CEO: 62.5% NEOs(1): 50.0% | | | | | | | | | | | | | | | | | | | | | | | Incentives | | | | | | | | | | | | Business Unit Performance

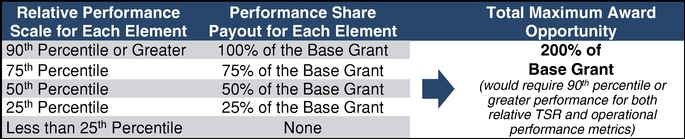

CEO: 37.5% NEOs(1): 50.0% | | | | | | | | | | | | | | | | | | | | | | | | | | | Election of directorsPerformance | | | | | | | | üRelative TSR50% | | | | | | | | | | | | | | | | | | | | | | | FOR each nomineeLong-Term Incentives | | 25 | Advisory vote to approve executive compensation | | üSharesFOR

60%(2) | | 91 | Ratification of Deloitte & Touche LLP ("D&T") as our independent accountants for 2016 | | üFOR3 years | | 92 | Shareholder proposal, if properly presented at the Annual Meeting | | XRelative Operational PerformanceAGAINST50% | | 96 |

6  |2016 Proxy Statement | | | | | | | | | | | | | | | | | | | | | | | Restricted

Stock Units

40%(2) | | | | Vest ratably

over

4 years | | | | Stock Price | | | | | | | | | | | | | | | | | | | | |

- (1)

- Named Executive Officers ("NEO") identified on page 44 of this Proxy Statement.

- (2)

- Long-term incentives award mix changed to 70% performance share awards and 30% restricted stock unit ("RSU") awards starting in 2018 for the CEO and Executive Vice Presidents.

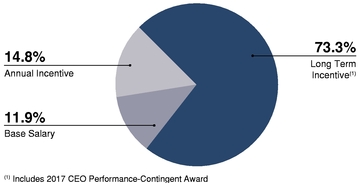

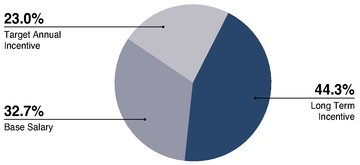

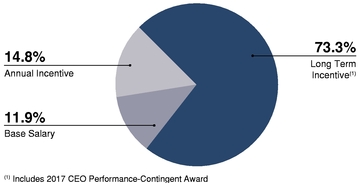

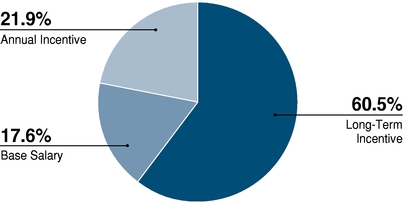

| | | 2017 CEO

Total Compensation

88% at risk

| | 2017 Average for Other NEOs'

Total Compensation

67% at risk

|

|---|

|

|

|

2018 Proxy Statement | 7 7

Table of Contents

Our director nominees are:

| | 2016 Proxy Statement | 7 |

Table of Contents

| | Proxy Statement — General Information |

| Place,Time, Date and TimePlace

|

The Company's 20162018 Annual Meeting of Shareholders ("Annual Meeting") will be held at the Heard Museum, 2301 North Central Avenue, Phoenix, Arizona 85004, at 10:30 a.m., Mountain Standard Time, on Wednesday, May 18, 2016.16, 2018. The Annual Meeting will not be held at a physical location, but will instead be held virtually, where shareholders will participate by accessing a website using the Internet. The Annual Meeting will be accessed atwww.virtualshareholdermeeting.com/PNW. To participate in the Annual Meeting, you will need the 16-digit control number included on the proxy card, the Internet Notice or the voting instruction form. Online check-in will begin at 10:15 a.m. Mountain Standard Time, and you should allow ample time for the online check-in proceedings. We will have technicians standing by ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call: 855-449-0991. An audio broadcast of the Annual Meeting will be available by telephone toll-free at 877-328-2502 (domestic) or 412-317-5419 (international). Upon dialing in, you will need to provide your 16-digit control number. We continue to believe that the virtual-only format, which we used for the first time last year, is in the best interests of our shareholders, given the time and expense of an in-person meeting compared to the shareholder participation at those meetings. The number of non-employee shareholders actually attending our Annual Meetings of Shareholders has significantly dwindled. For the past five in-person meetings, only about 30 shareholders attended each of the meetings. The meetings, on average, lasted less than 45 minutes, including the formal business portion of the meeting, the remarks by the CEO, a video highlighting the Company's performance, and the question and answer period. A virtual meeting allows all of our shareholders, regardless of location, the ability to participate in the Annual Meeting. Our virtual meeting will be governed by our Rules of Conduct, which we use for both in-person and virtual meetings. Shareholders at the virtual-only meeting will have the same rights as at an in-person meeting, including the rights to vote and ask questions through the virtual meeting platform.

| Notice of Internet Availability

|

Unless you elected to receive printed copies of the proxy materials in prior years, you will receive a Notice of Internet Availability of Proxy Materials by mail, or if you so elected, by electronic mail (the "Internet Notice"). The Internet Notice will tell you how to access and review the proxy materials. If you received an Internet Notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions included on the Internet Notice. The Internet Notice is first being sent to shareholders on or about March 31, 2016.29, 2018. The Proxy Statement and the form of proxy relating to the Annual Meeting are first being made available to shareholders on or about March 31, 2016.29, 2018. 8 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents | Proxy Statement — General Information |

| Record Date; Shareholders Entitled to Vote

|

All shareholders at the close of business on March 10, 20169, 2018 (the "Record Date") are entitled to vote at the meeting. Each holder of outstanding Company common stock is entitled to one vote per share held as of the record date on all matters on which shareholders are entitled to vote, except for the election of directors, in which case "cumulative" voting applies (see "Vote Required — Election of directors"). At the close of business on the Record Date, there were 111,138,441111,928,566 shares of common stock outstanding.

| | |  | | Vote prior to the Annual Meeting by Internet. The website address for Internet voting is on the proxy card, the Internet Notice and the Internet Notice.voting instruction form. Internet voting is available 24 hours a day. |

|

|

Vote prior to the Annual Meeting by telephone. The toll-free number for telephone voting is on yourthe proxy card.card, the Internet Notice and the voting instruction form. Telephone voting is available 24 hours a day. |

|

|

Scan thisVote prior to the Annual Meeting by scanning the QR device.code. The QR systemcode is on the proxy card, the Internet Notice and the voting instruction form, and is available 24 hours a day. |

|

|

Vote prior to the Annual Meeting by mail. You may vote by mail by promptly marking, signing, dating, and mailing your proxy card or voting instruction form (a postage-paid envelope is provided for mailing in the United States). |

8  |2016 Proxy Statement | | |

Table of Contents

PROXY STATEMENT — GENERAL INFORMATION |

| | |

|

|

Vote in personduring the Annual Meeting over the Internet. YouTo participate in the Annual Meeting, you will need the 16-digit control number included on the proxy card, the Internet Notice or the voting instruction form. Shares held in your name or shares for which you are the beneficial owner but not the shareholder of record may come to and vote atbe voted electronically during the formal business portion of the Annual Meeting. Shares held in the Pinnacle West 401(k) Plan cannot be voted during the Annual Meeting. If you hold your shares in street name,the Pinnacle West 401(k) Plan, you must obtain a proxy, executed inwill need to submit your favor, fromvote to the holder of record if you wishplan trustee by May 13, 2018 to vote these shares at the meeting. Please also review the requirements for attending the Annual Meeting under the heading "Attendance at the Annual Meeting" on page 11.your shares. |

If you vote by telephone or Internet, DO NOT mail a proxy card.

You may change or revoke your vote at any time beforeby: re-voting by telephone; re-voting by Internet; or re-voting during the formal business portion of the Annual Meeting. For shares held in your name you may change your vote by re-submitting a signed proxy is exercised by:card. In addition, for shares held in your name, you may also revoke a previously submitted proxy card by filing with our Corporate Secretary either a written notice of revocation orrevocation. For shares for which you are the beneficial owner but not the shareholder of record, you may change your vote by re-submitting a signed proxy card bearing a later date; re-voting by telephone; or re-voting by Internet. Your proxy will be suspended with respectvoting instruction form to your broker. In addition, for shares for which you are the beneficial owner but not the shareholder of record, you should contact your broker if you attend the meeting in person and so request, although attendance at the meeting will not by itselfwould like to revoke a previously-granted proxy.your vote. Your vote is confidential. Only the following persons have access to your vote: election inspectors; individuals who help with the processing and counting of votes; and persons who 2018 Proxy Statement | 9 9

Table of Contents Proxy Statement — General Information |

need access for legal reasons. All votes will be counted by an independent inspector of elections appointed for the Annual Meeting.

The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting. In counting the votes to determine whether a quorum exists, shares that are entitled to vote but are not voted at the direction of the beneficial owner (called abstentions) and votes withheld by brokers in the absence of instructions from beneficial owners (called broker non-votes) will be counted for purposes of determining whether there is a quorum. Shares owned by the Company are not considered outstanding or present at the meeting.

Election of directors. Individuals receiving the highest number of votes will be elected. The number of votes that a shareholder may, but is not required to, cast is calculated by multiplying the number of shares of common stock owned by the shareholder, as of the Record Date, by the number of directors to be elected. Any shareholder may cumulate his or her votes by casting them for any one nominee or by distributing them among two or more nominees. Abstentions will not be counted toward a nominee's total and will have no effect on the election of directors. You may not cumulate your votes against a nominee. If you hold shares in your own name and would like to exercise your cumulative voting rights, you must do so by mail. If you hold shares beneficially through a broker, trustee or other nominee and wish to cumulate votes, you should follow the instructions on the voting instruction form. | | | We employ a plurality voting standard with a director resignation policy because we believe a majority voting policy is inconsistent with cumulative voting, which is mandated by the Arizona Constitution. | | Election of directors. Individuals receiving the highest number of votes will be elected. The number of votes that a shareholder may, but is not required to, cast is calculated by multiplying the number of shares of common stock owned by the shareholder, as of the Record Date, by the number of directors to be elected. Any shareholder may cumulate his or her votes by casting them for any one nominee or by distributing them among two or more nominees. Abstentions will not be counted toward a nominee's total and will have no effect on the election of directors. You may not cumulate your votes against a nominee. If you hold shares beneficially through a broker, trustee or other nominee and wish to cumulate votes, you should contact your broker, trustee or nominee. If you would like to exercise your cumulative voting rights, you must do so by mail. The Company's Bylaws provide that in an uncontested election, a director nominee who receives a greater number of votes cast "withheld" for his or her election than "for" such election will promptly tender his or her resignation to the Corporate Governance Committee. The Corporate |

| | 2016 Proxy Statement | 9 |

Table of Contents

PROXY STATEMENT — GENERAL INFORMATION |

| | | | | Governance Committee is required to evaluate the resignation, taking into account the best interests of the Company and its shareholders, and will recommend to the Board whether to accept or reject the resignation. |

|

|

Under the current rules of the New York Stock Exchange ("NYSE"), your broker is not able to vote on your behalf in any director election unless you give your broker specific voting instructions. We encourage you to provide instructions so that your shares will be counted in the election of directors. |

Say-on-Pay.Say-on-Pay vote. The votes cast "for" must exceed the votes cast "against" to approve the advisory resolution on the compensation disclosed in this Proxy Statement of our Named Executive OfficersNEOs identified on page 44 — the Say-on-Paysay-on-pay vote. This resolution is not intended to address any specific item of compensation, but rather the overall compensation of the Named Executive OfficersNEOs and the compensation philosophy, policies and procedures described in this Proxy Statement. Because your vote is advisory, it will not be binding on the Board or the Company. However, theThe Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes will have no effect on the outcome of this proposal. We will hold an advisory vote on Say-on-Paysay-on-pay on an annual basis until we next hold an advisory vote of shareholders on the frequency of such votes as required by law.

Ratification of the appointment of the independent accountants and approval of the shareholder proposal.accountants. The votes cast "for" must exceed the votes cast "against" to ratify the appointment of the independent accountants for the year ending December 31, 2016 and for the approval of the shareholder proposal.2018. Abstentions and broker non-votes will have no effect on the outcome of these proposals. With respect to the shareholder proposal, because your vote is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take into consideration our shareholders' views.this proposal.

Board Recommendations.The Board recommends a vote:

- ü

- FOR the election of the nominated slate of directors (Proposal 1);

- ü

- FOR the approval, on an advisory basis, of the resolution approving the compensation of our

Named Executive Officers,NEOs, as disclosed in this Proxy Statement (Proposal 2); and

10 | |

2018 Proxy Statement

Table of Contents | Proxy Statement — General Information |

- ü

- FOR the ratification of the appointment of D&T as the Company's independent accountants for the year ending December 31,

20162018 (Proposal 3); and.

XAGAINST the approval of the shareholder proposal (Proposal 4).

The Board is not aware of any other matters that will be brought before the shareholders for a vote. If any other matters properly come before the meeting, the proxy holders will vote on those matters in accordance with the recommendations of the Board or, if no recommendations are given, in accordance with their own judgment. 10  |2016 Proxy Statement

| | |

Table of Contents

PROXY STATEMENT — GENERAL INFORMATION |

| Attendance at the Annual Meeting

|

Only shareholders as of the Record Date, or a validly designated proxy, are invited to attend the Annual Meeting. We have implemented the following procedures for attendance at the Annual Meeting:

•Security. You will need both an admission card and a current government-issued picture identification (such as a driver's license or a passport) to enter the meeting. Please follow the instructions below and an admission card will be mailed to you. Please do not carry items such as large handbags and packages to the meeting, as we reserve the right to inspect any items brought into the meeting. Weapons are prohibited in the meeting. We also reserve the right to prohibit bringing cell phones, pagers, cameras, recording devices, banners, signs, and other items into the meeting room.

•Who can attend the meeting and how to obtain an admission card. Attendance is limited to Pinnacle West shareholders as of the Record Date or their validly designated proxy. You must pre-register and obtain an admission card in advance if you plan to attend the meeting. Please follow the instructions below that correspond to how you hold your Pinnacle West stock:

oIf you hold your Pinnacle West shares directly with the Company and you received a proxy card or you hold your Pinnacle West shares through the Pinnacle West Capital Corporation Savings Plan: Please follow the advance registration instructions set forth on your proxy card, which was included in the mailing from the Company;

oIf you hold your Pinnacle West shares directly with the Company and you received a Notice of Internet Availability of Proxy Materials or you received your proxy materials by e-mail: Please follow the advance registration instructions provided when you vote by mobile device or the Internet or, if you vote by telephone, please follow the steps below for submitting an advance registration request and include a copy of your Notice of Internet Availability of Proxy Materials or e-mail, as applicable, as your proof of ownership;

oIf you hold your Pinnacle West shares through a broker, bank or other institutional account: Please send an advance registration request containing the information listed below to:

Pinnacle West Capital Corporation

Shareholder Services Department

P.O. Box 53999, Mail Station 8602

Phoenix, AZ 85072-3999

•PLEASE INCLUDE THE FOLLOWING INFORMATION IN A REQUEST FOR AN ADMISSION CARD:

oYour name and complete mailing address;

oThe name of any other shareholder who will accompany you (the other shareholder's name must appear on the documentation showing ownership of the stock);

| | 2016 Proxy Statement | 11 |

Table of Contents

PROXY STATEMENT — GENERAL INFORMATION |

oIf you will be sending a validly designated proxy to attend the meeting on your behalf, the name, address and telephone number of that individual; and

oProof that you own Pinnacle West shares as of the Record Date (such as a letter from your bank or broker, or a photocopy of your voting instruction form or Notice of Internet Availability of Proxy Materials).

Admission cards will be mailed to shareholders who register before May 12, 2016. Admission cards for requests submitted after May 12, 2016 will be available the day of the Annual Meeting.

| Delivery of Annual Reports and Proxy Statements to a Shared Address and Obtaining a Copy of the Annual Report

|

If you and one or more shareholders share the same address, it is possible that only one Internet Notice, Annual Report or Proxy Statement was delivered to your address. Registered shareholders at the same address who wish to receive separate copies of the Internet Notice, the Annual Report or Proxy Statement may: - •

- Call the Company's Shareholder Services Department at 1-602-250-5511;

- •

- Mail a request to Shareholder Services at P.O. Box 53999, Mail Station 8602, Phoenix, Arizona, 85072-3999; or

- •

- E-mail a request to: shareholderdept@pinnaclewest.com.

The Company will promptly deliver to you the information requested. ShareholdersRegistered shareholders who share the same address but wish to receive one Internet Notice, Annual Report or Proxy Statement may contact the Company through the same methods listed above. Shareholders who own Company stock through a broker and who wish to receive single or separate copies of the Internet Notice, Annual Report or Proxy Statement should contact their broker. You may access our Annual Report and Proxy Statement via the Internet. Copies of the Annual Report and Proxy Statement are available on the Company's website (www.pinnaclewest.com) and will be provided to any shareholder promptly upon request. Shareholders may request copies from Shareholder Services at the telephone number or addresses set forth above, or as described on the Internet Notice. 12  |2016 Proxy Statement

| | |

Table of Contents

PROXY STATEMENT — GENERAL INFORMATION |

| Shareholder Proposals or Director Nominations for the 20172019 Annual Meeting

|

Shareholder Proposals.To be included in the proxy materials for the 20172019 Annual Meeting of Shareholders (the "2017"2019 Annual Meeting"), any shareholder proposal intended to be presented must be received by our Corporate Secretary no later than December 1, 2016November 29, 2018 at the following address: Corporate Secretary

Pinnacle West Capital Corporation

400 North Fifth Street, Mail Station 8602

Phoenix, Arizona 85004 A shareholder who intends to present a proposal at the 20172019 Annual Meeting, but does not wish it to be included in the 20172019 proxy materials, must submit the proposal no earlier than January 18, 201716, 2019 and no later than the close of business on February 17, 2017. Nominations15, 2019. 2018 Proxy Statement | 11 11

Table of Contents Proxy Statement — General Information |

Shareholder Nominations. Shareholder nominations for a director to the Board must be received by the Corporate Secretary at the address set forth above by November 19, 2016. 16, 2018 ("Shareholder Nomination"). Proxy Access. In February 2017, our Board amended the Bylaws to provide, among other things, that under certain circumstances a shareholder or group of shareholders may include director candidates that they have nominated in our annual meeting proxy statement — "proxy access." Under these provisions, a shareholder or group of up to 20 shareholders seeking to include director nominees in our annual meeting proxy statement must own 3% or more of our outstanding common stock continuously for at least the previous three years. Generally the number of qualifying shareholder-nominated candidates the Company will include in its annual meeting proxy materials will be limited to the greater of 25% of the Board or two candidates. Based on the current Board size of 11 directors, the maximum number of proxy access candidates we would be required to include in our proxy materials is two. Nominees submitted under the proxy access provisions that are later withdrawn or are included in the proxy materials as Board-nominated candidates will be counted in determining whether the 25% maximum has been reached. If the number of shareholder-nominated candidates exceeds 25%, each nominating shareholder or group of shareholders may select one nominee for inclusion in our proxy materials until the maximum number is met. The order of selection would be determined by the amount (largest to smallest) of shares of our common stock held by each nominating shareholder or group of shareholders. Requests to include shareholder-nominated candidates under proxy access must be received by our Corporate Secretary at the address set forth above not earlier than the close of business on October 30, 2018 nor later than the close of business on November 29, 2018. The number of qualifying shareholder-nominated candidates the Company will include in its proxy materials under proxy access will be reduced on a one-for-one basis in the event the Company receives a Shareholder Nomination, but at least one qualifying shareholder-nominated proxy access nominee will be included in the proxy materials. In all cases, shareholders and nominees must also comply with the applicable rules of the Securities and Exchange Commission ("SEC") and the applicable sections of our Bylaws.Bylaws relating to qualifications of nominees and nominating shareholders and disclosure requirements.

The Board is soliciting the enclosed proxy. The Company may solicit shareholders over the Internet, by telephone or by mail. The Company has retained D.F. King & Co., Inc. to assist in the distribution of proxy solicitation materials and the solicitation of proxies for $10,500,$11,000, plus customary expenses. The costs of the solicitation will be paid by the Company. Proxies may also be solicited in person, by telephone or electronically by Company personnel who will not receive additional compensation for such solicitation. As required, the Company will reimburse brokerage houses and others for their out-of-pocket expenses in forwarding documents to beneficial owners of our stock. | 12 | 2018 Proxy Statement | 2018 Proxy Statement | | 2016 Proxy Statement | 13 |

Table of Contents

| | Information About Our Board and Corporate Governance |

| Board Meetings and Attendance

|

| | | In 20152017 each of our Directors had perfect (100%) attendance.directors attended 90% of the Board meetings and any meetings of Board committees on which he or she served. | | In 2015,2017, our Board held seven meetings and alleach of our directors attended 100%90% of the Board meetings and any meetings of Board committees on which he or she served. Each director is expected to be present atparticipate in the Annual Meeting. All of the Board members attended the 20152017 Annual Meeting. |

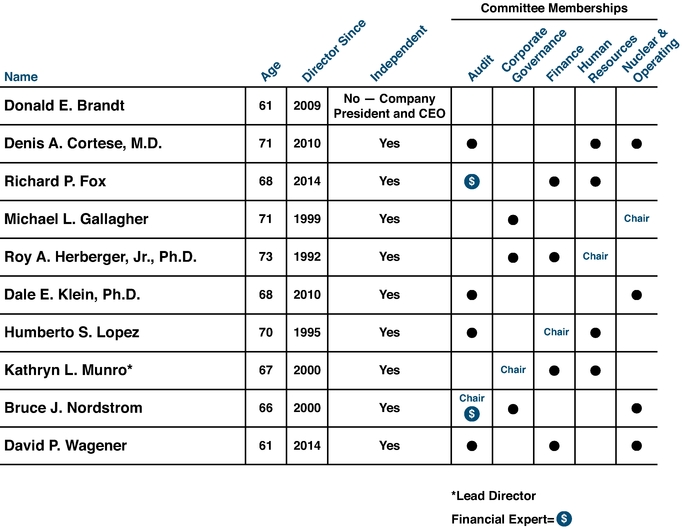

The Board has the following standing committees: Audit; Corporate Governance; Finance; Human Resources; and Nuclear and Operating. All of the charters of the Board's committees are publicly available on the Company's website (www.pinnaclewest.com). All of our committees conduct a formal review of their charters every other year and as often as any committee member deems necessary. In the years in which a formal review is not conducted, the Board has tasked management with reviewing the charters and recommending any changes management deems necessary or reflective of good corporate governance. The charters are also changed as needed to comply with any corresponding changes to any applicable rule or regulation. 2018 Proxy Statement | 13 13

Table of Contents Information About Our Board and Corporate Governance |

All of our committees are comprised of independent directors who meet the independence requirements of the NYSENew York Stock Exchange ("NYSE") rules, SEC rules, and the Company's Director Independence Standards, including any specific committee independence requirements. The duties and responsibilities of our committees are as follows: | | | | |

| | AUDIT COMMITTEE | RESPONSIBILITIES

| | NUMBER OF

MEETINGS

DURING

FISCAL 2015

|

|---|

| | | | | | Number of Meetings in 2017: 6 |

RESPONSIBILITIES: | AUDIT

COMMITTEE:

Bruce J. Nordstrom,

Chair

Denis A. Cortese

Richard P. Fox

Dale E. Klein

Humberto S. Lopez

David P. Wagener |

|

|

COMMITTEE MEMBERS: | | | | | | The Audit Committee: • Oversees the integrity of the Company's financial statements;statements and internal controls; • Appoints the independent accountants and is responsible for their qualifications, independence, performance (including resolution of disagreements between the independent accountants and management regarding financial reporting), and compensation; • ReviewsParticipates in the performanceselection of the Company's internal audit function; and

independent accountants' new lead engagement partner each time a mandatory rotation occurs;

• Monitors the Company's general compliance with legal and regulatory requirements.requirements; • Sets policies for hiring employees or former employees of the independent accountants; • Reviews the annual audited financial statements or quarterly financial statements, as applicable, and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained therein; |

| 6 | | • Bruce J. Nordstrom, Chair

• Denis A. Cortese

• Richard P. Fox

• Dale E. Klein

• Humberto S. Lopez

• David P. Wagener

"The audit function is critical

to sound risk and financial

management, and the

members of the Audit

Committee are committed

to carrying out fully our

duties to the Company and

our shareholders."

-Bruce Nordstrom | | | • Discusses with management and the independent accountants significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements; • Reviews the Company's draft earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies; • Discusses guidelines and policies to govern the process by which risk assessment and risk management is undertaken across the Company and periodically reviews the principal risks related to the Company's financial statements, audit functions and other major financial risk exposures; and • Reviews management's monitoring of the Company's compliance with the Company's Code of Ethics and Business Practices. The Board has determined that each member of the Audit Committee meets the NYSE experience requirements and that Mr. Nordstrom, the Chair of the Audit Committee, and Mr. Fox are "audit committee financial experts" under applicable SEC rules. None of the members of our Audit Committee, other than Mr. Fox, currently serve on more than three public company audit committees. Mr. Fox currently serves on the audit committees of four public companies, including Pinnacle West. Our Board has discussed with Mr. Fox the time and effort required to be devoted by Mr. Fox to his service on these committees and has affirmatively determined that such services do not impair Mr. Fox's ability to serve as an effective member of our Audit Committee. | | | | |

14  |2016 Proxy Statement | | |

14 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

| | | | |

| | CORPORATE GOVERNANCE COMMITTEE | RESPONSIBILITIES

| | NUMBER OF

MEETINGS

DURING

FISCAL 2015

|

|---|

| | | | | | Number of Meetings in 2017: 5 |

RESPONSIBILITIES: | CORPORATE

GOVERNANCE

COMMITTEE:

Kathryn L. Munro,

Chair

Michael L. Gallagher

Roy A. Herberger, Jr.

Bruce J. Nordstrom |

|

|

COMMITTEE MEMBERS: | | | | | | The Corporate Governance Committee: • Reviews and assesses the Corporate Governance Guidelines; • Develops and recommends to the Board criteria for selecting new directors; • Identifies and evaluates individuals qualified to become members of the Board, consistent with the criteria for selecting new directors; • Recommends director nominees to the Board; • Recommends to the Board who should serve on each of the Board's committees; • Reviews the results of the Annual Meeting shareholder votes; and • Reviews and makes recommendations to the Board regarding the selection of the CEO and CEO and senior management succession planning.planning; • Reviews the Company's Code of Ethics and Business Practices for compliance with applicable law; | | 5 | | • Kathryn L. Munro, Chair

• Michael L. Gallagher

• Roy A. Herberger, Jr.

• Bruce J. Nordstrom

"The Corporate Governance

Committee is focused on

effective and accountable

governance practices in

order to maximize the

long-term value of the

Company for its

shareholders."

-Kathy Munro | | | • Recommends a process for responding to communications to the Board by shareholders and other interested parties; • Reviews the independence of members of the Board and approves or ratifies certain types of related-party transactions; • Reviews and makes recommendations to the Board regarding shareholder proposals requested for inclusion in the Company's proxy materials; • Reviews and makes recommendations regarding proxy material disclosures related to the Company's corporate governance policies and practices; • Periodically reviews the principal risks relating to the Company's corporate governance policies and practices; • Oversees the Board and committee self-assessments on at least an annual basis; and • Reviews and assesses the Company's Political Participation Policy, and then reviews the Company's policies and practices with respect to governmental affairs strategy and political activities in accordance with the Company's Political Participation Policy. The Corporate Governance Committee periodically reviews and recommends to the Board amendments to the Corporate Governance Guidelines and the Political Participation Policy. The Corporate Governance Guidelines and the Political Participation Policy are available on the Company's website (www.pinnaclewest.com). | | | | | | | |

|

|

|

|

| | | | | | |

2018 Proxy Statement | 15 15

Table of Contents Information About Our Board and Corporate Governance |

| | | | | | FINANCE COMMITTEE | | Number of Meetings in 2017: 4 |

RESPONSIBILITIES: | FINANCE

COMMITTEE:

Humberto S. Lopez,

Chair

Richard P. Fox

Roy A. Herberger, Jr.

Kathryn L. Munro

David P. Wagener |

|

|

COMMITTEE MEMBERS: | | | | | | The Finance Committee: • Reviews the historical and projected financial performance of the Company and its subsidiaries; • Reviews the Company's historicalfinancial condition, including sources of liquidity, cash flows and projected financial performancelevels of indebtedness; • Reviews and recommends approval of corporate short-term investment and borrowing policies; • Reviews the Company's financing plan and recommends to the Board approval of credit facilities and the issuance of long-term debt, common equity and preferred securities;securities, and the establishment of credit facilities; • Reviews the Company's use of guarantees and other forms of credit support; • Reviews and monitors the Company's dividend policies and proposed dividend actions; • Establishes and selects the members of the Company's Investment Management Committee to oversee the investment programs of the Company's trusts and benefit plans; | | | | • Humberto S. Lopez, Chair

• Richard P. Fox

• Kathryn L. Munro

• Paula J. Sims

• David P. Wagener

"The Finance Committee

plays a key role in ensuring

the financial health of the

Company by providing

oversight of the Company's

financial performance,

financing strategy and

dividend policies and

actions."

-Bert Lopez | • Reviews and discusses with management the Company's process for allocating and managing capital; • Reviews and recommends approval of the Company's annual capital budget and reviews the annual operations and maintenance budget; • Reviews the Company's annual operations and recommends approval of short-term investmentsmaintenance budget and borrowing policies; andmonitors throughout the year how the Company's actual spend tracks to the budget; • Reviews the Company's insurance programs; and recommends • Periodically reviews the principal risks relating to the Board the Company's dividend actions.

policies and practices concerning budgeting, financing and credit exposures. |

| | 4 |

| | | 2016 Proxy Statement | 15 |

16 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

| | | | |

| | HUMAN RESOURCES COMMITTEE | RESPONSIBILITIES

| | NUMBER OF

MEETINGS

DURING

FISCAL 2015

|

|---|

| | | | | | Number of Meetings in 2017: 7 |

RESPONSIBILITIES: | HUMAN

RESOURCES

COMMITTEE:

Roy A. Herberger, Jr.,

Chair

Denis A. Cortese

Richard P. Fox

Humberto S. Lopez

Kathryn L. Munro |

|

|

COMMITTEE MEMBERS: | | | | | | The Human Resources Committee: • Reviews management's programs for the attraction, retention, succession, motivation and development of the Company's human resources;resources needed to achieve corporate objectives; • Establishes the Company's executive compensation philosophy; • Recommends to the Board persons for election as officers; • Annually reviews the goals and performance of the officers of the Company and APS; • Approves corporate goals and objectives relevant to the compensation of the Company's CEO, assesses the CEO's performance in light of these goals and objectives, and sets the CEO's compensation based on this assessment; • Makes recommendations to the Board with respect to non-CEO executive compensation and director compensation; and • Acts as the "committee" under the Company's long-term incentive plans.plans; • Reviews and discusses with management the Compensation Discussion and Analysis on executive compensation set forth in our proxy statements; | | 4 | | • Roy A. Herberger, Jr., Chair

• Denis A. Cortese

• Richard P. Fox

• Humberto S. Lopez

• Kathryn L. Munro

"The members of the Human

Resources Committee are

committed to the

development of vigorous and

effective practices and

programs designed to attract

and retain the talent required

to achieve the Company's

goals and objectives and

drive shareholder value."

-Roy Herberger | | | • Reviews the number, type, and design of the Company's pension, health, welfare and benefit plans; and • Periodically reviews the principal risks relating to the Company's compensation and human resources policies and practices. Under the Human Resources Committee's charter, the Human Resources Committee may delegate authority to subcommittees, but did not do so in 2015.2017. Additional information on the processes and procedures of the Human Resources Committee is provided under the heading "Compensation Discussion and Analysis ("CD&A")". | | | | | | | |

|

|

|

|

| | | | | | |

2018 Proxy Statement | 17 17

Table of Contents Information About Our Board and Corporate Governance |

| | | | | | NUCLEAR AND OPERATING COMMITTEE | | Number of Meetings in 2017: 4 |

OPERATINGRESPONSIBILITIES: |

COMMITTEE:

Michael L. Gallagher,

Chair

Denis A. Cortese

Dale E. Klein

Bruce J. Nordstrom

David P. Wagener |

|

|

COMMITTEE MEMBERS: | | | | | | The Nuclear and Operating Committee: • Receives regular reports from management and monitors the overall performance of Palo Verde; • Reviews the results of major Palo Verde inspections and evaluations by external oversight groups, such as the Institute of Nuclear Power Operations ("INPO") and the Nuclear Regulatory Commission ("NRC"); • ReviewsMonitors overall performance of the principal non-nuclear business functions of the Company and monitors the power plant operations,APS, including fossil energy generation, energy transmission and delivery, and customer service, functions of the Company;fuel supply and transportation, safety, legal compliance, and any significant incidents or events;

• Reviews and monitorsregular reports from management concerning the Company's compliance with environmental, health and safety policies.("EH&S") policies and practices of the Company, and monitors compliance by the Company with such policies and applicable laws and regulations; • Reviews APS's planning for generation resources additions and significant expansions of its bulk transmission system; • Periodically reviews the principal risks related to the Company's nuclear, fossil generation, transmission and distribution, and EH&S operations; | | 4 | | • Michael L. Gallagher, Chair

• Denis A. Cortese

• Dale E. Klein

• Bruce J. Nordstrom

• Paula J. Sims

• David P. Wagener

"In managing the oversight of

the Company's overall

operations, the N&O

Committee takes enormous

accountability ensuring that

operations are performed in

an efficient, safe, and secure

manner. Cyber and physical

security are key focus areas

of the committee."

-Mike Gallagher | | | • Receives reports on the Company's sustainability initiatives and strategy;

and • Provides oversight of security policies, programs and controls for protection of cyber and physical assets. In addition, the Nuclear and Operating Committee receives regular reports from the OffsiteOff-Site Safety Review Committee (the "OSRC"). The OSRC provides independent assessments of the safe and reliable operations of Palo Verde. Pursuant to Palo Verde's operating licenses, the OSRC focuses its assessment on operations, engineering, maintenance, safety, security and other support functions. The OSRC is comprised of non-employee individuals with senior management experience in the nuclear industry and the Palo Verde Director of Nuclear Assurance. The OSRC meets periodically throughout the year. | | | | |

16  |2016 Proxy Statement | | |

18 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

| The Board's Leadership Structure

|

Lead Director. Kathryn L. Munro serves as the Company's Lead Director and chairs the Corporate Governance Committee. The Lead Director performs the following functions:duties and responsibilities as set forth in our Corporate Governance Guidelines: - •

- Serves as a liaison between the Chairman of the Board (the "Chairman") and the independent directors;

- •

- Advises the Chairman as to an appropriate schedule of Board meetings, reviews and provides the Chairman with input regarding agendas for the Board meetings and, as appropriate or as requested, reviews and provides the Chairman with input regarding information sent to the Board;

- •

- Presides at all meetings at which the Chairman is not present, including executive sessions of the independent directors (which are regularly scheduled as part of each Board meeting) and calls meetings of the independent directors when necessary and appropriate;

- •

- Oversees the Board and Board committee self-assessment process;

- •

- Is available for appropriate consultation and direct communication with the Company's shareholders and other interested parties; and

- •

- Performs such other duties as the Board may from time to time

delegate;delegate.

These duties and

•Reviews responsibilities do not, however, fully capture Ms. Munro's active role in serving as our Lead Director. For example, Ms. Munro has regular discussions with the resultsCEO, other members of the Annual Meeting shareholder votes.senior management team and members of the Board between Board meetings on a variety of topics, and she serves as a liaison between the CEO and the independent directors. Ms. Munro focuses the Board on key issues facing our Company and on topics of interest to the Board. She takes the lead on director recruitment and has a formal annual call with each non-employee director to discuss the Board, its functions, its membership, the individual's plan with respect to his or her continuing Board service, and any other topic the individual desires to discuss with our Lead Director. Her leadership fosters a Board culture of open discussion and deliberation to support sound decision-making. She also encourages communication between management and the Board to facilitate productive working relationships.Chairman and CEO Positions. The Chairman is Donald E. Brandt, the Company's President and CEO. The independent directors believe that Mr. Brandt, as an experienced leader with extensive knowledge of the Company and our industry, serves as a highly effective conduit between the Board and management and that Mr. Brandt provides the vision and leadership to execute on the Company's strategy and create shareholder value. The Board believes that separating the roles of the CEO and Chairman and appointing an independent Board Chairman at this time would simply create an additional level of unneeded hierarchy that would only duplicate the activities already being vigorously carried out by our Lead Director. | | 2016 Proxy Statement | 17 |

2018 Proxy Statement | 19 19

Table of Contents Information About Our Board and Corporate Governance |

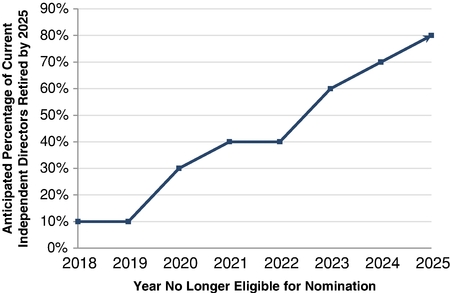

Succession Planning and Board Evaluations

|

Management Succession. Our Board places a high priority on senior management development and succession planning. While the Corporate Governance Committee has principal responsibility for overseeing CEO and other senior management succession planning, the full Board is actively involved in reviewing our senior management succession plans that will allow for smooth and thoughtful leadership transitions in the future. Executive succession planning and senior management development were specific areas of focus for the Corporate Governance Committee in 2017. The Corporate Governance Committee engaged in thorough and thoughtful discussions regarding the development and evaluation of current and potential senior leaders, as well as the development of executive succession plans, including succession plans for our CEO position. Board Succession. Our Board has developed a robust process to refresh the Board and its leadership significantly over the next several years and beyond. The process is designed to continue to provide for a well-qualified, diverse and highly independent Board, with the requisite experience and skills to provide effective oversight. This process includes the identification of the current key skills and experience possessed by our members. A matrix of current key skills and experience possessed by our Board is on page 5 of this Proxy Statement. The identification of these skills and experiences, combined with a comprehensive Board evaluation process, provide visibility into the skills and experience leaving our Board in the future and allows for the identification of additional skills, experience or expertise needed to facilitate the Company's long-term strategy. This information is taken into account when identifying director nominees during the recruitment process. Board Evaluations. The Corporate Governance Committee has established a thorough evaluation process wherein each Director completes a Board evaluation as well as an individual self-evaluation annually. The Board evaluation allows each Director the opportunity to examine and evaluate the Board's composition and effectiveness, competency, accountability, deliberations and administration, and each committee, as well as the opportunity to identify any skills, experience or expertise the Director believes should be represented, or more fully represented, on the Board. The individual self-evaluation asks each Director to evaluate different areas of their performance as a Director, including independence, expertise, judgment and skills. The Board assessment results are reviewed both on a one-year standalone basis and on a three-year basis in order to identify any year-over-year trends. The assessment results are initially reviewed by the Lead Director. The Lead Director then has a formal annual call with each Director to discuss the Board, its functions, its membership, the individual's plan with respect to his or her continuing Board service, and any other topic the individual desires to discuss with our Lead Director. The results of the evaluations and calls are presented to the Corporate Governance Committee and full Board each February. This process provides the Board the ability to assess the overall functioning of the Board as a whole, and identify any skills, experience or expertise needed to continue to provide effective oversight of the Company's long-term strategy. 20 | 2018 Proxy Statement | 2018 Proxy Statement

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

| The Board's Role in Risk Oversight

|

| | | Top risks discussed by the Board and its committees in 20152017 included cyber security,cybersecurity, data privacy and ownership, physical security, and utility regulation. The Board believes it is important to look at the list fresh each year as part of a diligent risk review. | | The ultimate responsibilityResponsibility for the management of the Company's risks rests with the Company's senior management team. The Board's oversight of the Company's risk management function is designed to provide assurance that the Company's risk management processes are well adapted to and consistent with the Company's business and strategy, and are functioning as intended. The Board focuses on fostering a culture of risk awareness and risk-adjusted decision-making and ensuring that an appropriate "tone at the top" is established. The Board regularly discusses and updates a listing of areas of risk and a suggested allocation of responsibilities for such risks among the Board and the Board committees. The charter for each of our committees requires each committee to periodically review risks in their respective areas. Each committee:• Receives periodic presentations from management about its assigned risk areas; • ConsidersReceives information about the effectiveness of the risk identification and mitigation measures being employed; and

• Discusses their risk reviews with the Board at least annually. |

Consistent with the requirements of the NYSE's corporate governance standards, the Audit Committee periodically reviews the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee also reviews the comprehensiveness of the Board's risk oversight activities and the Company's risk assessment process, and plays a coordinating role designed to ensure that no gaps exist in the coverage by the Board committees of risk areas. In recommending the composition of the Board's committees and the selection of committee Chairs, the Corporate Governance Committee takes into account the effective functioning of the risk oversight role of each Board committee and the risk areas assigned to it. The Executive Risk Committee is comprised of senior level officers of the Company and is chaired by the Chief Financial Officer. Among other responsibilities, this Committee is responsible for ensuring that the Board receives timely information concerning the Company's material risks and risk management processes. The Executive Risk Committee provides the Board with a list of the Company's top risks on an annual basis. The internal enterprise risk management group reports to the Vice President, Controller and Chief Accounting Officer, who reports to the Executive Vice President and Chief Financial Officer. The internal risk management group is responsible for (1) implementing a consistent risk management framework and reporting process across APS,the Company, and (2) ensuring that the Executive Risk Committee is informed of those processes and regularly apprised of existing material risks and the emergence of additional material risks. | 2018 Proxy Statement | 21 21 18  |2016 Proxy Statement | | |

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance

|

| Director Resignation Due to a Substantial Change in their Primary Business PositionPolicies

|

| | | | We employ a plurality voting standard with a director resignation policy because we believe a majority voting policy is inconsistent with cumulative voting, which is mandated by the Arizona Constitution. | | With respect to the election of directors, the Company's Bylaws provide that in an uncontested election, a director nominee who receives a greater number of votes cast "withheld" for his or her election than "for" such election will promptly tender his or her resignation to the Corporate Governance Committee. The Corporate Governance Committee is required to evaluate the resignation, taking into account the best interests of the Company and its shareholders, and will recommend to the Board whether to accept or reject the resignation. |

Under the Company's Corporate Governance Guidelines, upon a substantial change in a director's primary business position from the position the director held when originally elected to the Board, a director is required to apprise the Corporate Governance Committee and to offer his or her resignation for consideration to the Corporate Governance Committee. The Corporate Governance Committee will recommend to the Board the action, if any, to be taken with respect to the tendered resignation.

| Director Retirement Policy

|

Under the Company's Corporate Governance Guidelines, an individual shall not be eligible to be nominated for election or re-election as a member of the Board of the Company or APS if, at the time of the nomination, the individual has attained the age of 75 years. This policy shall apply regardless of the source of the nomination or whether the nomination was made at a meeting of the Board of Directors, at an Annual Meeting or otherwise. | 22 | 2018 Proxy Statement | 2018 Proxy Statement | | 2016 Proxy Statement | 19 |

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

| Shareholder Engagement and Communications with the Board

|

Our Goal.What our shareholders think is important to us. We seek to maintain a transparent and productive dialogue with our shareholders by: - ü

- Providing clear and timely information,

- ü

- Seeking and listening to feedback, and

- ü

- Being responsive.

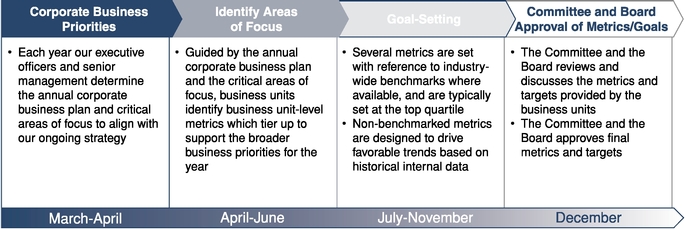

Our Plan. To accomplish this goal, we have a long-standing investor outreachan established shareholder engagement program conducted throughout the yeardesigned to maintain a dialogue with currentour shareholders, which was further augmented during 2017 in response to what the Board considered a disappointing level of shareholder support for our annual advisory vote on compensation. Each year we strive to respond to shareholder questions in a timely manner, conduct extensive proactive outreach to investors, and potential shareholders. Forevaluate the last several years,information we have also hadprovide to investors in an increasingly active proxy engagement program in supporteffort to continuously improve our engagement. In 2017, we contacted the holders of approximately 50% of the Annual Meeting,shares outstanding and met with the holders of approximately 40% of the shares outstanding. Our Lead Director and member of the Human Resources Committee, Kathryn Munro, participated in ordera number of the shareholder discussions providing shareholders with direct access to understand the governance priorities ofBoard.

Our Results. We listened to our shareholders. Discussion topics include governance best practices,After considering their feedback, the Board makeup, compensation policiesin late 2017 and sustainability. The diagram below provides an overviewearly 2018 made several changes in response: - ü

- Increased the proportion of performance shares in our

outreach program cycle:CEO's and Executive Vice Presidents' 2018 long-term incentive awards from 60% to 70%;

- ü

- Clarified how our performance metrics support and align with our long-term strategy;

- ü

- Revised 2018 metrics in certain key business units to better align with our priorities and emphasize top-quartile and above performance;

2018 Proxy Statement | 23 23

Table of Contents Information About Our Board and Corporate Governance |

- ü

- Adopted a formalclawback policy;

- ü

- EnhancedCD&A disclosures;

- ü

- Redesignedannual incentive disclosure;

- ü

- Added detail on how we select ourpeer group;

- ü

- Added specificresponsibility for oversight of sustainability matters to the charter of the Nuclear and Operating Committee; and

- ü

- Included a director key skills and experience matrix in this Proxy Statement.

Shareholders and other parties interested in communicating with the Board may do so by writing to the Corporate Secretary, Pinnacle West Capital Corporation, 400 North Fifth Street, Mail Station 8602, Phoenix, Arizona 85004, indicating who should receive the communication.85004. The Corporate Secretary will transmit such communications, not otherwise specifically addressedas appropriate, depending on the facts and circumstances outlined in the communications. In that raise substantial issues toregard, the Lead Director and to the Chair of the Board Committee most closely associated with the matter. The Corporate Secretary has discretion to exclude communications that are unrelated to the duties and responsibilities of the Board, such as commercial advertisements or other forms of solicitations, service or billing complaintsmatters and complaints related to individual employment-related actions. 20  |2016 Proxy Statement

| | |

Table of Contents

INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCE |

| Codes of Ethics and APS Core Strategic Framework

|

To ensure the highest levels of business ethics, the Board has adopted the Code of Ethics and Business Practices, which applies to all employees, officers and directors, and the Code of Ethics for Financial Executives, both of which are described below: Code of Ethics and Business Practices ("Code of Ethics"). Employees, directors and officers receive access to and training on the Code of Ethics when they join the Company or APS, as well as any subsequentannual updates. The Code of Ethics helps ensure that employees, directors and officers of the Company and APS act with integrity and avoid any real or perceived violation of the Company's policies and applicable laws and regulations. The Company provides periodicannual online training and examination covering the principles in the Code of Ethics. This training includes extensive discussion of the Company's values, an explanation of Company ethical standards, application of ethical standards in typical workplace scenarios, information on reporting concerns, assessment questions to measure understanding, and an agreement to abide by the Code of Ethics. All employees of the Company and APS and all of our directors complete the training. Code of Ethics for Financial Executives. The Company has adopted a Code of Ethics for Financial Executives, which is designed to promote honest and ethical conduct and compliance with applicable laws and regulations, particularly as related to the maintenance of financial records, the preparation of financial statements, and proper public disclosure. "Financial Executive" means the Company's CEO, Chief Financial Officer, Chief Accounting Officer, Controller, Treasurer, General Counsel, the President and Chief Operating Officer of APS, and other persons designated from time to time as a Financial Executive subject to this policythe Code of Ethics for Financial Executives by the Chair of the Audit Committee. Both codes are available on the Company's website (www.pinnaclewest.com(www.pinnaclewest.com)). | 24 | 2018 Proxy Statement | 2018 Proxy Statement | | 2016 Proxy Statement | 21 |

Table of Contents INFORMATION ABOUT OUR BOARD AND CORPORATE GOVERNANCEInformation About Our Board and Corporate Governance |

Core. The Company and APS have adopted Core, which is a strategic framework that sets forth the foundation from which we operate. It defines our vision, mission, critical areas of focus, and values. APS's vision is to create a sustainable energy future for Arizona. APS's mission is to safely and efficiently deliver reliable energy to meet the changing needs of our customers. The critical areas of focus are employees, operational excellence, security, environment, customer value, community, and shareholder value. The framework affirms our corporate values of safety, integrity and trust, respect and inclusion, and accountability. Here is our Core:

2018 Proxy Statement | 25 25

Table of Contents Information About Our Board and Corporate Governance |

| Director Qualifications and Selection of Nominees for the Board

|

Director Qualifications. The Bylaws and the Corporate Governance Guidelines contain Board membership criteria that apply to nominees recommended for a position on the Board. Under the Bylaws, a director must be a shareholder of the Company. In determining whether an individual should be considered for Board membership, the Corporate Governance Committee considers the following core characteristics: - •

- High Standards: We look for directors that set high standards and expectations for themselves and others and the accomplishment of those standards and expectations.

- •

- Informed Judgment: Directors should be thoughtful in their deliberations. We look for directors who demonstrate intelligence, wisdom and thoughtfulness in decision-making.

22  |2016 Proxy Statement | | |

Table of Contents